Charles Mellon

Chapter 3: profitable portfolio management.

- When you look for a buy and hold stock, choose companies using the following criteria:

- A long history of strong earnings, at least 3 to 5 years’ worth.

- A stock that pays dividends, which you can invest, either in that stock or in other stocks.

- A company that dominates its product or industry categories.

Chapter 4: diversification essentials.

- I always suggest that investors put no more than 20% of their holdings in any one security.

Chapter 5 golden rules for investment success.

- A sell stop order at 10% below the current market value.

- Whatever your intention is, you must hold to it. If you buy ABC stock thinking that when earnings are announced next week the stock should move up and then you can sell it for a profit, sell the stock after the earnings are announced, no matter what.

- I set my maximum loss on option purchases at 50% of the price I paid for the options.

Chapter 5: mutual funds.

- Morningstar is perhaps the most comprehensive mutual fund rating service.

- The first thing I look for is total return.

- Beta is the relative volatility of the fund when compared to the market as a whole. A beta of 1.0 means that the funds volatility is equal to the overall market. A beta of, say, 0.75, indicates a fund is 25% less volatile than the overall market.

- The first thing I look for is total return. How much money would I have made if I bought this fund on January 1st.

- A Beta is the relative volatility of the funds when compared to the market as a whole. A beta of 1.0 means that the funds volatility is equal to the overall market. A beta of, 0.75, indicates the fund is 25% less volatile than the overall market.

Chapter 8: what to look for in stocks.

- Know something about the company you are planning to invest in.

- I want to invest in companies that have an historic track record of increased sales each year.

- Therefore, I have a choice of two stocks in the same industry group, I try to select the one that pays dividends, all other things being equal.

- I always look at the company’s price / earnings ratio, or P / E, that’s the ratio between what each share of the stock turns divided by the current price of that share.

- At the present time, 2001, the average stock listed on the NYSE trades at about 25 times earnings. I look for stocks that are within these averages or less. A high p /e ratio can spell potential trouble for long term investor, because the price of the stock is not supported by the amount of earnings the company is taking.

Chapter 9: value investing, where’s the real value?

- I generally like to look for stocks that are currently in an upswing, stocks where investor perception is high and getting higher so that I can ride the tide even lost your levels.

Chapter 10: market timing.

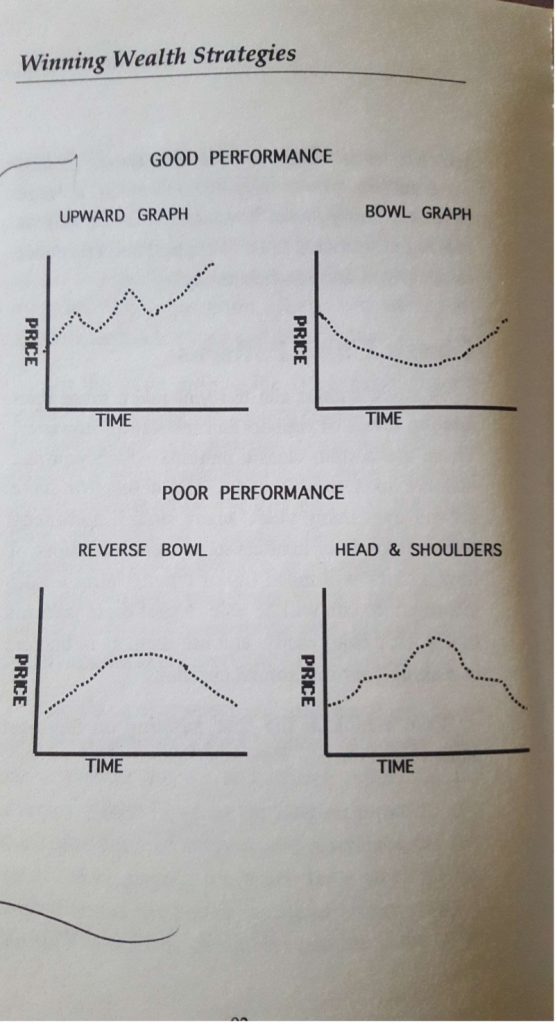

- The bowl graph is one of my favorite patterns, because I want to buy the stock as it moves up, rather than buying and holding for a long period of time.

Chapter 11: stock terms language and orders.

- The bid is what you could currently sell the stock for if you owned it. The ask is how much you will pay if you want to buy the stock.

- Stop limit orders – – avoid them!

Chapter 13: when to take profits – – or a loss.

- It sometimes pays very handsome to accept a small loss and get into something else. Keeping winners and selling losers has made more men rich than poor.

- I would advise taking profits when the stock situation has changed enough that you believe the stock is no longer a bargain at the present price level.

Section 3: momentum investing

- Momentum strategies are short-term investments, and require more attention to long-term buy-and-hold strategies.

Chapter 14: fundamentals of options.

- A call gives the option for the right, but not the obligation, to purchase a certain stock at a specific price for a certain period of time. You could think of the option Joe bought on your house as a call option. The $5,000 he paid gave Joe the right, but not the obligation to buy a house for $300,000.

- A put is an option that gives the owner the right to sell a stock at a certain price for a specific period of time. A put holder lock in the price at which he wants to be able to sell the stock.

- Think of puts as a way of being able to sell high when the price is low.

Chapter 15: how options trading works.

- We rarely if ever by an option to exercise it.

Covered Calls

- Covered Calls: Example #1

- Let’s see how effective covered calls can be in generating cash flow. Say you owned 1,000 shares of ABCD stock, which you purchased for $18 a share. When you purchased the stock six months ago, you felt that it had prospects of rising to about $25. Since then, though, it has done virtually nothing and its prospects don’t look that great. You would be happy to sell it for just about any price above what you paid for it.

- Covered Call Guidelines

- The stock should be of good quality and commensurate with your risk tolerance and investment objectives.

- There should have been some price movement (volatility) in the stock, and it should not have languished at a particular price level for a long period of time. If there has been little movement in options on that stock, and therefore a much smaller market (i.e., fewer people who want to buy or sell options).

Chapter 18: index options.

- I usually trade OEX options because they have great liquidity, many institutions trade these options too. You may have an index that is a particular favorite, as do I. The important thing to remember is to choose an index that best represents the makeup of your stock portfolio. Section of a broad-based index or one more narrow in scope should be commensurate with your overall investment objectives and the type of stocks you own.

- I have found the best way to reasonably hedge against a portfolio decline without paying excess portfolio insurance premiums is to buy a current month put option 5 strike prices out of your money.

Chapter 18: advanced plays I: straddles and strangles.

- One of the best strategies to make money involves the simultaneous purchase of a call and they put on the same stock at the same strike price. This is called a straddle.

- The assumption is that no matter which way the stock moves, we will participate in that movement in a profitable manner. If the stock shows strong growth, up side movement, we would participate on the call side of the straddle. Conversely, should the stock show weakness, we would only put that would increase in value as the stock declined.

- First and foremost, it is important that the stock has sufficient volatility.

- At this point then, you decide to do your straddle. You would buy both a put and a call at the same strike price with the same expiration date. The key is to spend no more than a percentage of what you think the expected price movement in the stock will be.

- The rule of thumb in a straddle is, never spend more than 50% of the expected movement of your stock for the call and put options combined.

- Let’s take a more specific example. If XYZ. We’re at $75 per share, and you believe the stock will go up or down by at least 10 points, you would buy the XYZ $75 puts and the XYZ $75 calls for a combined premium cost of No more than $5, 50% of the expected movement of the price of the stock. If XYZ continues to move up, the calls will be worth more than the amount of money we would lose on the puts. If the stock goes down dramatically, the puts will be worth more than the amount on the calls.

- Let’s say that XYZ moved from $75 per share to $80 a few days after you bought the straddle. The $75 calls would be worth probably $6 to $7, and the $75 puts would be worth perhaps $1, for a combined value of $7 to $8. But remember, you purchased the calls and outs for a combined premium of $5. You’ve made about 40% to 60% on your investment. If you adhere to the rules of not paying more than 50% of the expected movement for the combined options, you should have many. Many happy and profitable trading days.